He also talks about risk and advises to be careful holding positions overnight. If you are involved in the financial markets and not concerned about the wave of artificial intelligence, machine learning and bots entering the realm, maybe should be. This is one of the best trading books to read to get a better understanding of its impact.

- https://g-markets.net/wp-content/themes/barcelona/assets/images/placeholders/barcelona-sm-pthumb.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-sSNfW7vYJ1DcITtE.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-vQW4Fia8IM73qAYt.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/male-hand-with-golden-bitcoin-coins-min-min.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-NCdZqBHOcM9pQD2s.jpeg

Revised and expanded for the demands of today’s financial world, this book is essential reading for anyone interested in tracking and analyzing market behavior. In 2005, Joel Greenblatt published a book that is already considered one of the classics of finance literature. Now, with a new Introduction and Afterword for 2010, The Little Book that Still Beats the Market updates and expands upon the research findings from the original book.

What is my book about?

This is another example of a beginner-friendly book that should be referenced every few months to keep you fresh on the basics. If you’re a beginner day trader, this should be near the top of your “to-read” list. It’s written in simple English and goes from classic strategies to nitty-gritty trading practices. While it doesn’t go deep into any particular area it gives a good bird’s-eye overview of everything.

This book comes from a highly experienced author who understands numerous advanced topics to do with HFT such as data cleaning, machine learning and financial theory. It does not talk about individual strategies or rules but rather the framework with which to tackle quant trading and how to evaluate quant trading firms. Shortly before the dotcom bubble he warned of stock market exuberance and shortly before 2008 he warned of a housing bubble. His knowledge and expertise make this an insightful book for fundamental investors and macro enthusiasts.

trading books

Very little are from actual people who aspired, achieved, and lost it. With each and every successful move that he made, Jim Paul, who made it to Governor of the Chicago Mercantile Exchange, was convinced that he was special, different, and exempt from the rules. Once the markets turned against his trades, he lost it all — his fortune, job, and… These rules worked—and still work today—for the Turtles, and any other investor with the desire and commitment to learn from one of the greatest investing stories of all time.

He has a polymathic command of subjects ranging from cognitive science to best trading books of all time to probability theory. The astonishing success of Google was a black swan; so was 9/11. For Nassim Nicholas Taleb, black swans underlie almost everything about our world, from the rise of religions to events in our own personal lives. The ancestor of all the pale imitations, like Rich Dad/Poor Dad, that came since. And while I scoffed at plenty of the allegories from ancient Babylon that presents the lessons, it was still a neat package.

You and I want the same thing; we both want that secret wisdom legendary traders have. While reading through the best trading books won’t necessarily guarantee that, it will offer a great start and some considerable knowledge on what to do to improve your skills. “Security Analysis” by Benjamin Graham and David Dodd is a classic investing book that provides a detailed analysis of the principles of value investing. The book emphasizes the importance of analyzing financial statements and balance sheets and provides practical tools and strategies for identifying undervalued stocks. It’s a great resource for anyone interested in learning more about value investing. Another book that I really enjoyed was “Reminiscences of a Stock Operator” by Edwin Lefèvre.

What Are Trading Books?

The ability for Investimonials members to create their own lists is coming soon, but for now, check out all my various Investimonials Lists ranging from best stock brokers, to my favorite investing books/movies etc. It’s a great trading book of his system where you can follow his method step by step. If you are a beginner trader and unsure about how to start trading, this book will be of great help in showing you the importance of following a trading plan with discipline. Combining chart patterns with the10X Trading System buy and sell signals is a great way to add confluence to your trading and find the best trade setups.

What is Arbitrage? Stock Trading Explained Beginner’s Guide – Finbold – Finance in Bold

What is Arbitrage? Stock Trading Explained Beginner’s Guide.

Posted: Mon, 11 Jul 2022 07:00:00 GMT [source]

This https://g-markets.net/ will feature interviews with a variety of traders who achieved phenomenal financial success during the glory days of the Internet boom. In contrast with the first two Market Wizard books, which included traders from a broad financial spectrum – stocks, bonds, currencies and futures – this volume will focus on traders in the stockmarket. This book covers the basic principles of investing in the stock market.

One Up On Wall Street

A revised edition, first printed in 2003, includes additional commentary by financial journalist Jason Zweig, who explains how to apply the principles outlined in the book to today’s markets. Written by John J. Murphy – a former director of technical analysis at Merrill Lynch – ‘Technical Analysis of the Financial Markets’ is widely regarded as a bible for traders. It covers everything from basic concepts through to advanced indicators, and includes more than 400 charts to bring technical analysis to life.

What is Moving Average in Stock Trading? Definition & Examples – Finbold – Finance in Bold

What is Moving Average in Stock Trading? Definition & Examples.

Posted: Fri, 26 Aug 2022 07:00:00 GMT [source]

That’s why James Dalton, a pioneer in the popularization of Market Profile, has returned with a new edition of this essential guide. Such individuals attract devoted followers who believe in their guru’s insights and methods. The other books in the series are The Black Swan, Antifragile, Skin in the Game, and The Bed of Procrustes. “Two years in MBA school won’t teach you how to double the market’s return.

Market Wizards

Some of the legendary traders featured include Paul Tudor Jones, Ed Seykota, and more. This book is great for traders that already have a basic understanding of technical terms as it doesn’t focus on beginning topics it just dives into the interviews. These books allow you to learn from the greatest options traders of all time.

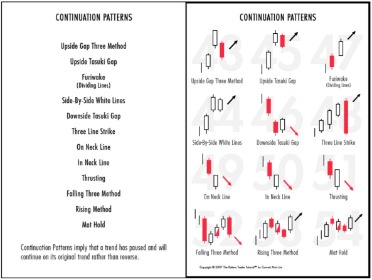

Buffett advocates using a “margin of safety” when investing, which means only purchasing stocks when priced significantly below their intrinsic value. It also gives guidance on the importance of having a long-term perspective and not making impulsive decisions based on short-term market fluctuations. The book describes what individual candlesticks and combinations of candlesticks can tell you about what other traders are doing. This is not a trading book but I’ve found it to be one of the books that helped me the most in my trading. Before we say goodbye, we’d like to mention two other very important books for your growth in the trading world, both written by Andrea Unger.

His trading style works in today’s currency market and will forever do so going forward. Jesse Livermore was one of the worlds best traders at the time, a trader who made and lost fortunes many times over. It doesn’t really explain all the forex trading indicators but focuses primarily on the trend trading turtle system only. This book is a bit of a lighter read than the others and is very focused on the strategy and the story behind it.

This book focuses on Mean Reversion trading and shares different techniques to trade it. Systems Trading is a great way to trade the markets because the rules are fixed and there’s no second guessing yourself. It’s a no-BS-straight-talk book about how the Forex market really works. Then, it tells you why the odds are stacked against you and how you can apply specific trading strategies to level the playing field. This book dives deep into how the Forex market works by explaining the participants in the Forex market and their reason for trading. Fundamental analysis explained in a simple step by step manner .

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-Le61UcsVFpXaSECm.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-KGbpfjN6MCw5vdqR.jpeg

Once the market was open, no one in the office was allowed to speak until the market closed. Previous editions covered the stock and housing markets – and famously predicted their crashes. “Stan Weinstein’sSecrets For Profiting in Bull and Bear Marketsreveals his successful methods for timing investments to produce consistently profitable results.

Tags: